KNOWLEDGE CENTRE

Processing Partial Payments against Purchase Orders

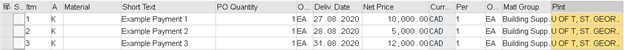

When partial payments are expected, it is recommended, when possible to set up the purchase order to mirror the partial delivery and payment structure. This will simplify the processing of Goods Receipts and Invoice Receipts, when possible.

When that is not possible, the processing of partial Goods Receipts and Invoice Receipts may be required.

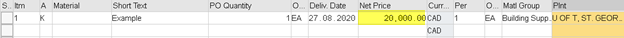

Example: PO with Quantity 1 and Net Price $20,000

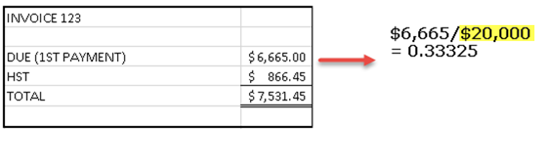

1. Based on the partial payment due, you will have to calculate the required Goods Receipt quantity to be received that corresponds to the amount being paid. (Note: The PO “Net Price” is the amount before taxes)

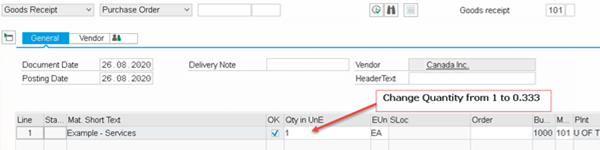

2. Process the Goods Receipt (MIGO) and change the Quantity. The system will accommodate for up to 3 decimal places.

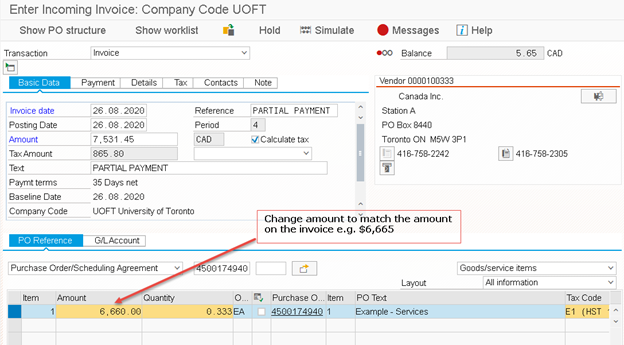

3. Process the Invoice Receipt (MIRO). In some instances, due to the 3 decimal place system limitation and resulting rounding, the document may not balance (in example below net price calculated was $6,660). If that is the case, change the Amount to match the amount, before taxes, on your invoice. Do not change the quantity.

Learn More:

- Reference Guide: MIGO: Create Goods Receipt

- Reference Guide: MIRO: Create Invoice Receipt

- Purchase Order Invoice – GTFM

Last Updated: August 5, 2021