KNOWLEDGE CENTRE

Understanding TACO Customs Charges

Thompson, Ahern & Co. Limited (TACO) is the appointed Canadian Customs Broker for the University of Toronto. As such, if you utilize this broker, you will see a 60-series document posted to your accounts for the customs/brokerage charges related to your purchase. The net amount after tax rebate and the appropriate taxes have been calculated by the customs brokerage interface. Your account will be charged accordingly (with tax code J9).

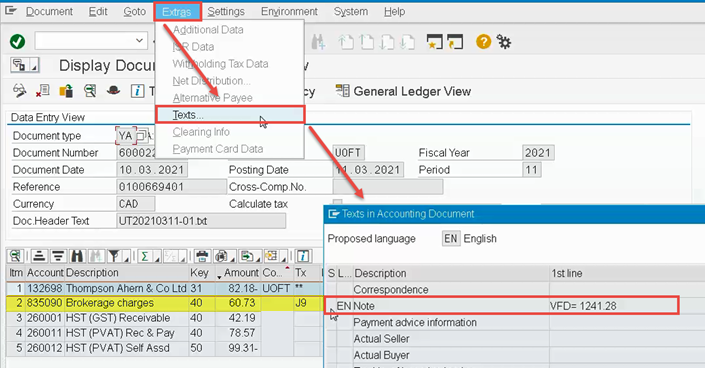

To view the details of the customs charges and the amounts which the tax calculations are based on, go to FB03-Document Display. Once the document has been displayed, select Extras>>Texts and double-click the Note line item:

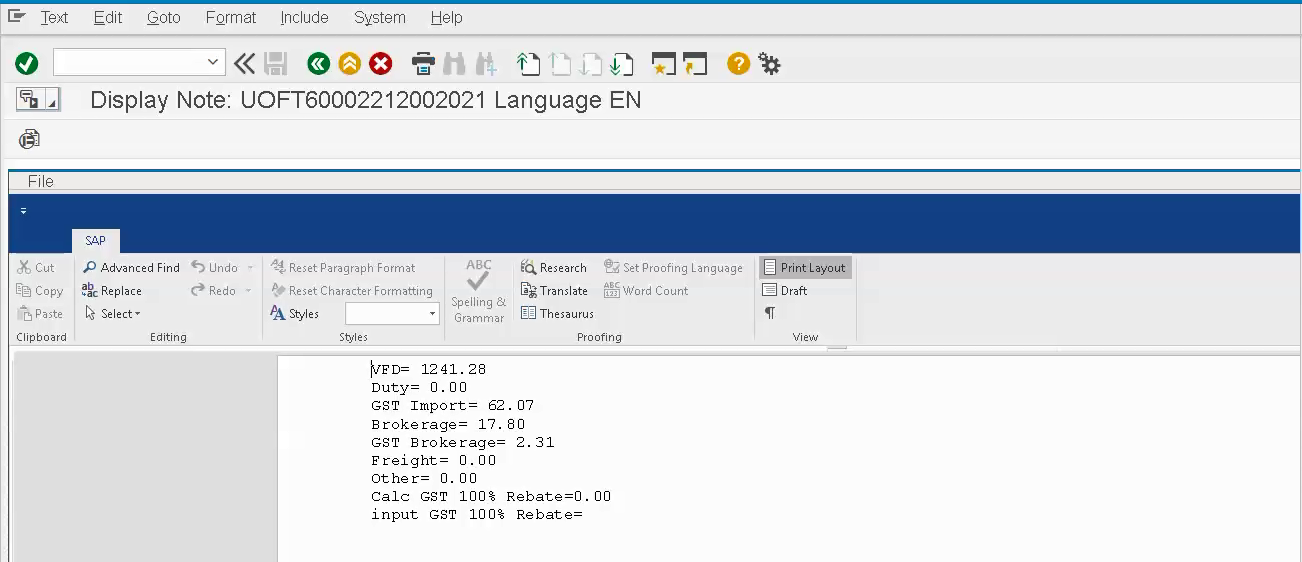

A pop-up window will appear providing details of the customs charges and taxes:

In this example, the vendor was paid $82.18 which represents the taxes and brokerage fees invoiced. The departmental FIS accounts have been charged $60.73 based on the calculations shown below:

Net of Rebate HST: calculated using VFD ($1,241.28 x 0.0341) = $42.33

Brokerage Fee: $17.80 + Net of Rebate HST ($17.80 x 0.0341 = $0.60) = $18.40

Total charge to departmental account: = $42.33 + $18.40 = $60.73

LEARN MORE:

- Procurement Website: Customs Information

- Reference Guide: Document Display

- Reference: HST Tax Code Summary Table

Last Updated: March 18, 2022