KNOWLEDGE CENTRE

What GL Account should you use when purchasing Computer Software?

Choosing the correct General Ledger account ensures that the University is accurately recording all financial transactions. This flows through and impacts the accuracy of our financial and tax reporting.

GL accounts associated with the purchase of software licenses have been particularly misused/misunderstood. Due to how software purchases are capitalized (i.e. software purchases over $5,000 before tax), it is important to distinguish between software licenses that are:

- Purchased – Payment for the purchase or development of software with perpetual usage rights/license (i.e. software can be used for an indefinite period of time)

- Licensed/Subscription – periodic payments for renewable software licenses/subscription or maintenance (i.e. permission to use for a period of time on a non-exclusive basis)

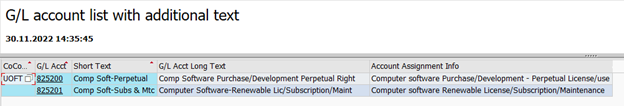

To clarify the GL Account selection process, we have renamed the following two GL accounts and provided additional details below.

GL 825200: Computer Software - Perpetual Rights purchase

Used for payments for perpetual rights/licenses that allows the software user to use the software for an indefinite period.

If the perpetual license is valued greater than $5,000 before tax, it is considered a capital asset.

GL 825201: Computer Software - Renewable License/Subscription/Maintenance

Payment for a software license/subscription with permission to use software on a non-exclusive basis, and subject to the listed conditions. A software license does not automatically transfer the ownership of the software to the buyer.

Often requires a monthly, quarterly or annual license/subscription fee.

Examples include: Microsoft licenses, Adobe, Zoom, SAP, Service Cloud, Linkedin, Public Programs, Softchoice, Alibaba, Safenet, Amazon Web Services, ServiceNow, Global Fleet Management, Matlab TAH, etc.

Used for payments for perpetual rights/licenses that allows the software user to use the software for an indefinite period.

If the perpetual license is valued greater than $5,000 before tax, it is considered a capital asset.

GL 825201: Computer Software - Renewable License/Subscription/Maintenance

Payment for a software license/subscription with permission to use software on a non-exclusive basis, and subject to the listed conditions. A software license does not automatically transfer the ownership of the software to the buyer.

Often requires a monthly, quarterly or annual license/subscription fee.

Examples include: Microsoft licenses, Adobe, Zoom, SAP, Service Cloud, Linkedin, Public Programs, Softchoice, Alibaba, Safenet, Amazon Web Services, ServiceNow, Global Fleet Management, Matlab TAH, etc.

Getting Help with Selecting the Most Appropriate Account

To assist in selecting the most appropriate GL account, generate the G/L Account List with Additional Text report to locate a descriptions of each GL account.

Learn More:

Last Updated: May 31, 2024