KNOWLEDGE CENTRE

What is the 48-series document number I see in my Purchase Order history and on my reports?

This document is created as part of the GR/IR Clearing process, which is used to clear Goods Receipt and Invoice Receipt variances. The transaction makes an accounting correction based on a difference between a GR and an IR. The entry will adjust any accounts impacted by the imbalance. Below are examples of some scenarios showing PO’s with GR/IR variances that will result in a 48-series document being posted:

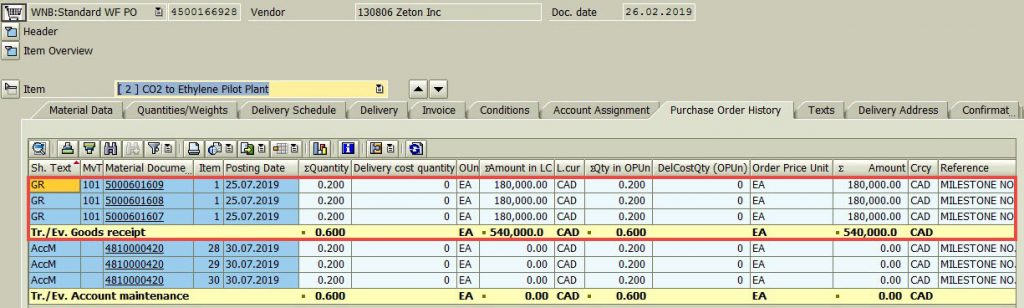

Example 1: GR documents posted with no corresponding IR’s (GR Surplus)

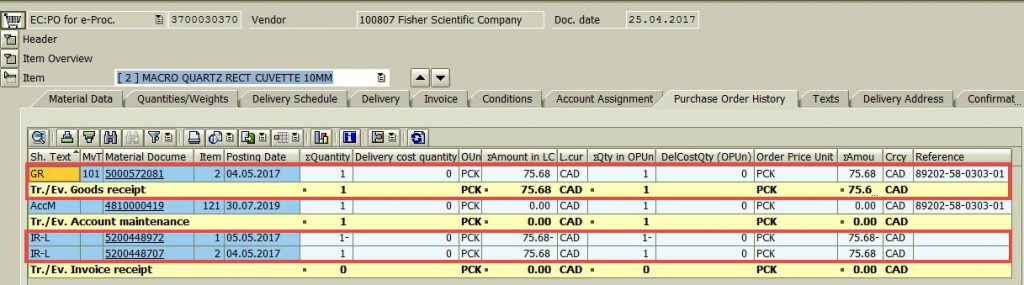

Example 2: IR document reversed with no corresponding GR reversal (GR Surplus)

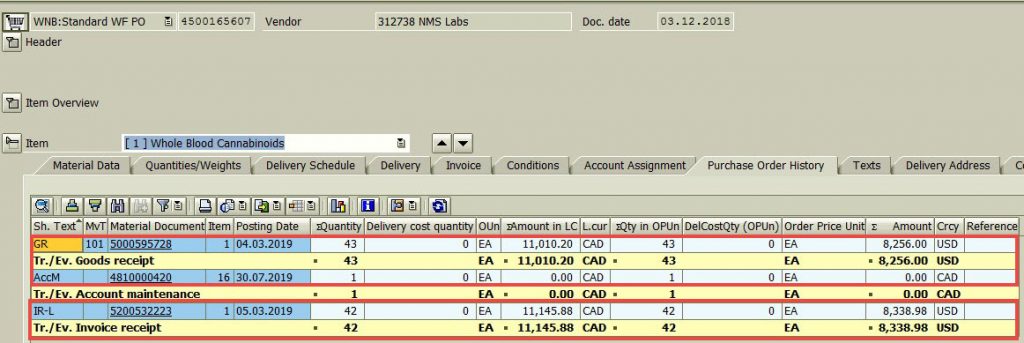

Example 3: IR quantity is less that GR quantity (GR Surplus)

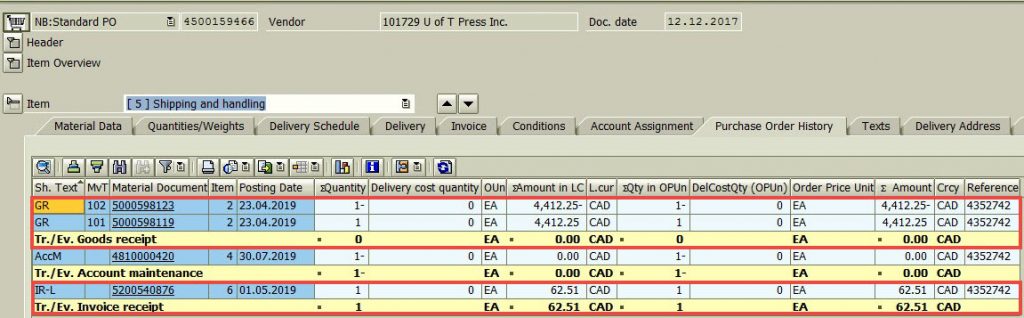

Example 4: IR processed after GR reversed (IR Surplus)

Last Updated: June 18, 2021