KNOWLEDGE CENTRE

I accidentally used an incorrect tax code while processing an invoice. The cheque has already been processed. Is it still possible to correct the tax code?

Yes, a correction is possible when an incorrect tax code has been used, in any transaction, even after it has already been processed. You’ll need to process a journal entry to credit the incorrect tax code and debit the correct tax code. Please see the example below.

For detailed instructions on how to create a journal entry, please refer to the “Journal Entry Create” quick reference guide (QRG):

Reference Guide: Create Journal Entry – FB50

The following illustrates an example of a document correcting an incorrect tax code:

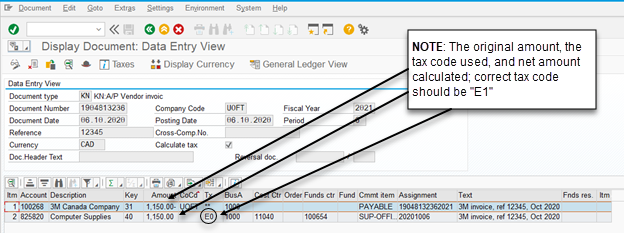

Original transaction containing the incorrect tax code:

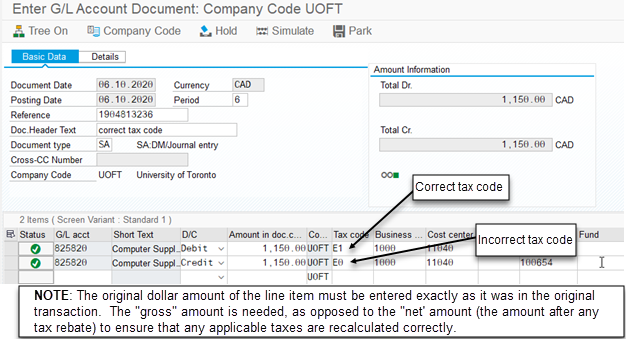

Journal Entry required to correct the tax code/amounts:

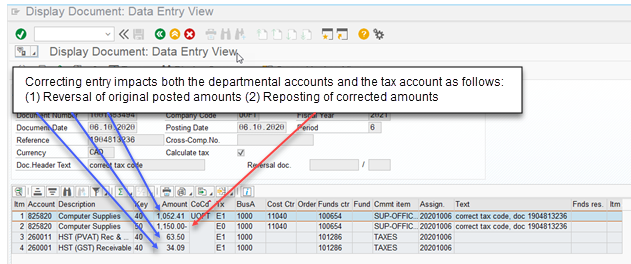

Impact of the tax recalculations on the $1150.00 example above:

Learn More:

- Reference – Tax Code Summary Table

- Documentation & Support – General Ledger

- Reference Guide: Internal Revenues/Expense Recoveries

- Simulation: Enter Internal Revenues/Expense Recoveries

- GTFM Policy – Harmonized Sales Tax (HST)

Last Updated: December 9, 2022