KNOWLEDGE CENTRE

How do I process an invoice to Avenue Travel?

Avenue Travel invoices outline specific charges for the booking, but typically do not outline the exact tax breakdown of each individual charge so it can be difficult to determine the proper tax codes, and ultimately the net of tax rebate the university is eligible for.

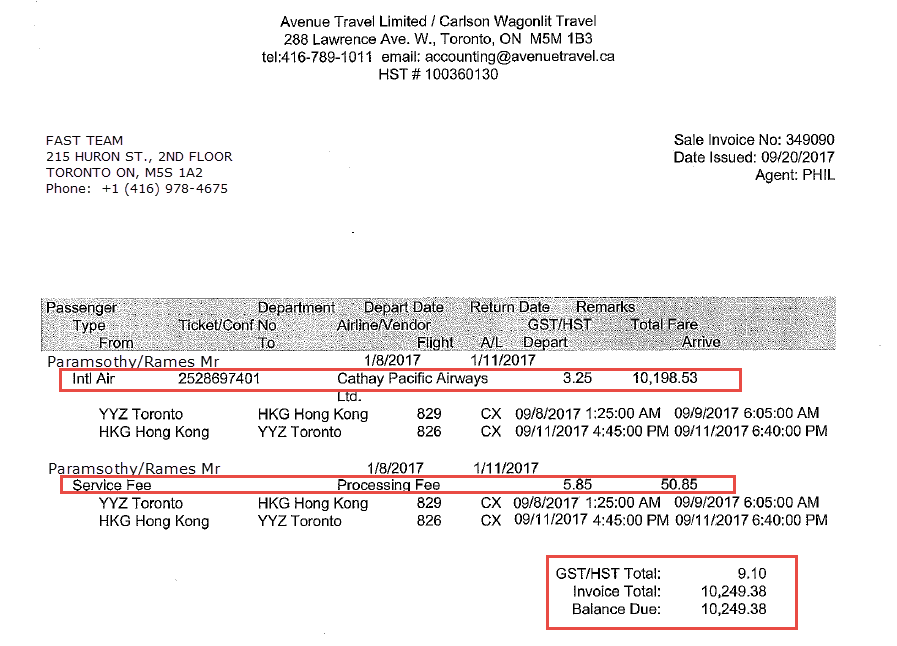

Example:

A University traveler purchased round-trip airfare from Toronto to Hong Kong and back. Based on the invoice it can be determined that Avenue Travel is to be paid $10,249.38.

However, the GST/HST indicated is ONLY $9.10 ($3.25 for Airfare plus $5.85 for Service/Processing Fee) which is much less than 13%.

Based on this invoice, you cannot determine the proper allocation of the tax and corresponding tax code(s).

Recommended Approach:

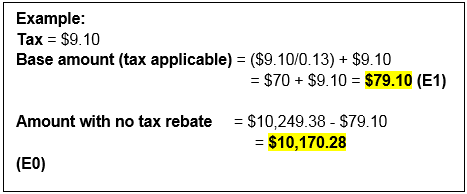

Based on the HST shown, calculate the unknown base amount of the invoice that had HST and use E1. The balance where no HST was charged will use E0.

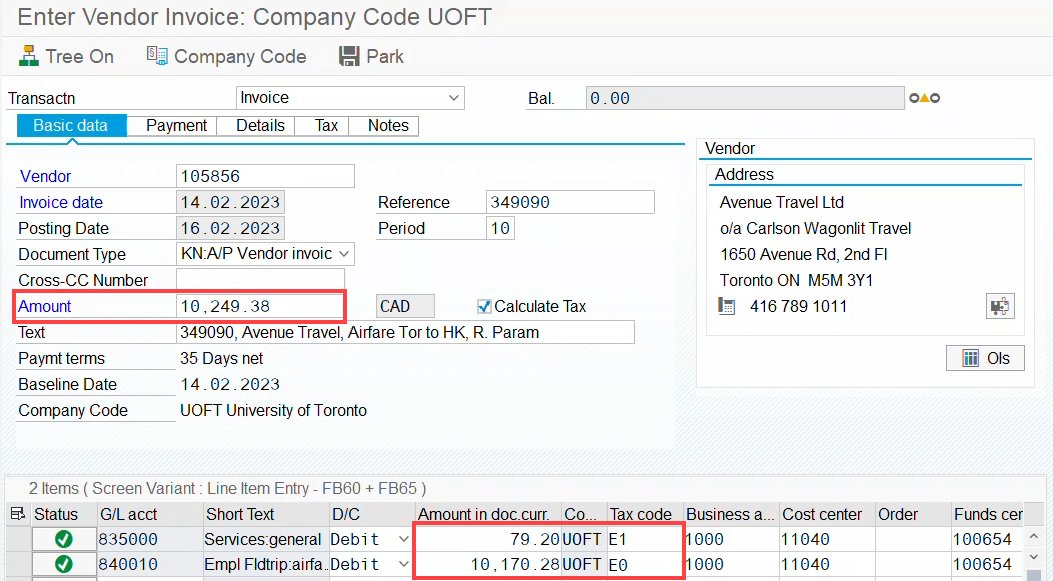

FIS AP Invoice Entry

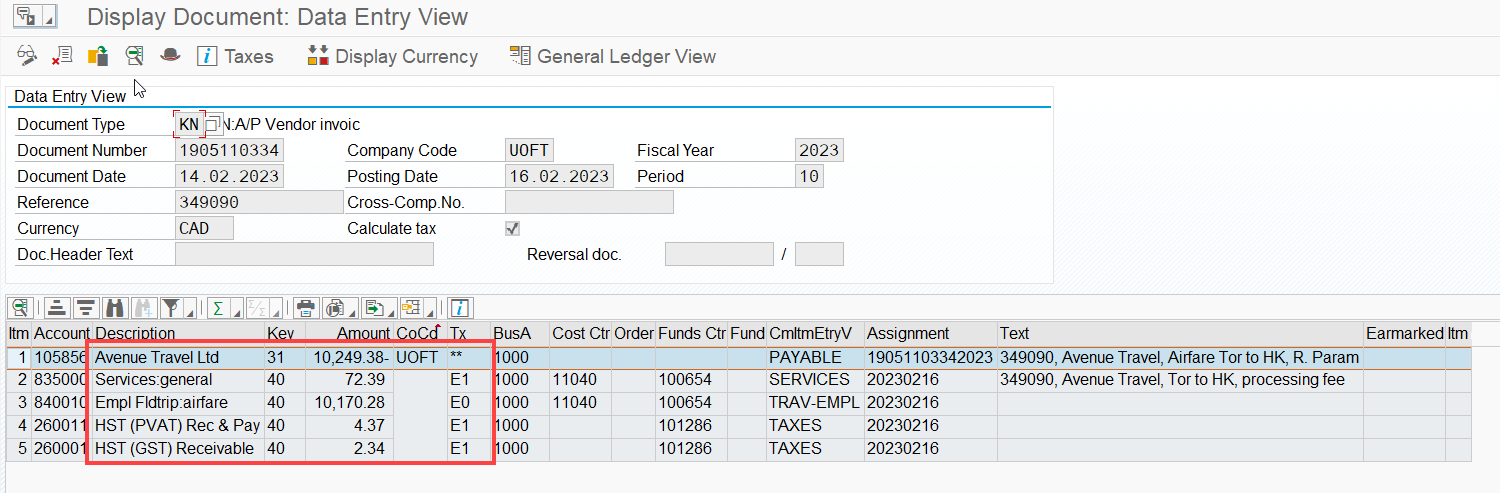

FIS Entry – After-Tax Rebate Amounts

Note: The invoice will be broken down the same way if processed by Financial Services.

Alternative Approach: If you do not wish to calculate the unknown base amount, process the entire invoice using tax code E0. Using this approach will result in the University not receiving any tax rebate.

Learn More:

Last Updated: February 16, 2023