KNOWLEDGE CENTRE

COVID-19 Expense Reimbursement Fund (CERF)

What is the CERF?

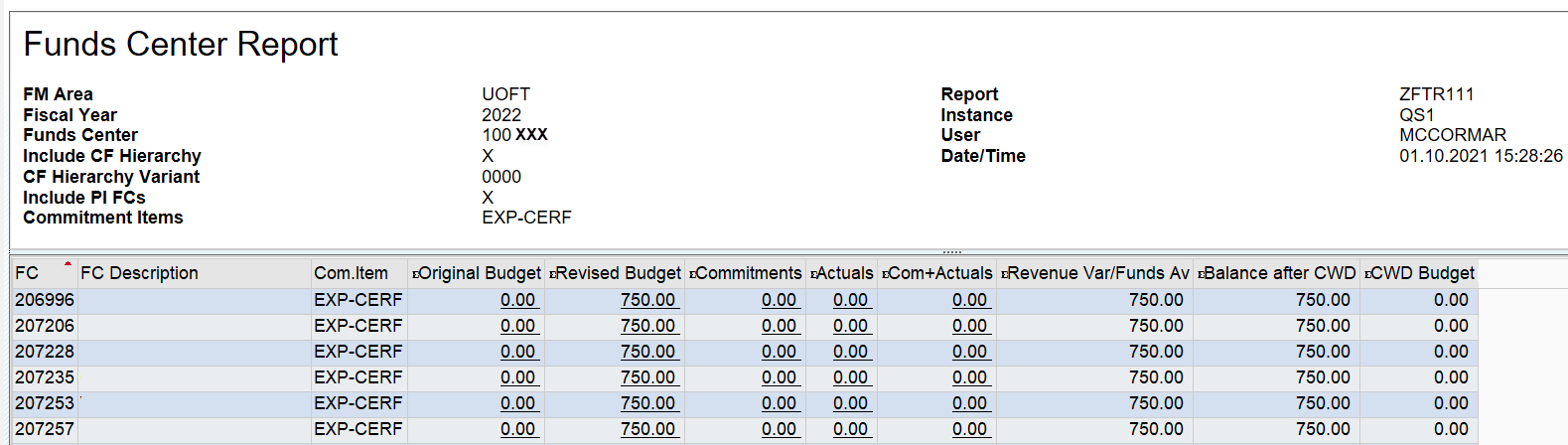

The University and UTFA reached an agreement on a COVID-19 specific Letter of Understanding (COVID LOU – Section 7.0) that included a provision for the CERF. Budget of $750 per eligible Faculty member and Librarian will be transferred to the PI Funds Center in a newly created Commitment Item EXP-CERF. Faculties/Divisions should not process any budget transactions against EXP-CERF.

Eligibility

Eligible expenses must be in accordance with the University of Toronto’s “Guide to Financial Management” and must be related to the performance of University of Toronto undergraduate and graduate teaching and, in the case of librarians, professional practice remotely due to the COVID-19 pandemic. They may include, but are not limited to: office furniture, microphones, cameras, ring lights, and computers.

Expenses must be incurred between March 1, 2020 and March 31st, 2022 and claims for reimbursement may be submitted up to March 31, 2022. All transactions must be posted by April 22, 2022 at 5pm, after which time any unused funds will be centrally transferred back to the original Faculty Fund Center.

Eligible expenses previously claimed under PERA can be reallocated to the CERF.

Any questions regarding the eligibility of expenses can be directed via Teams or email to Jessica Eylon in the Office of the Vice-Provost, Faculty & Academic Life.

Processing

Expense Reimbursements

Reimbursement claims should be processed using the standard Expense Reimbursement Direct Deposit SAP transaction (ZER01) or the ERDD-web application, with the ERDD vendor account (and personnel number). Expense claims should be posted against the Faculty member/Librarian’s Funds Center with the appropriate G/L account and the previously created Faculty COVID Internal Order.

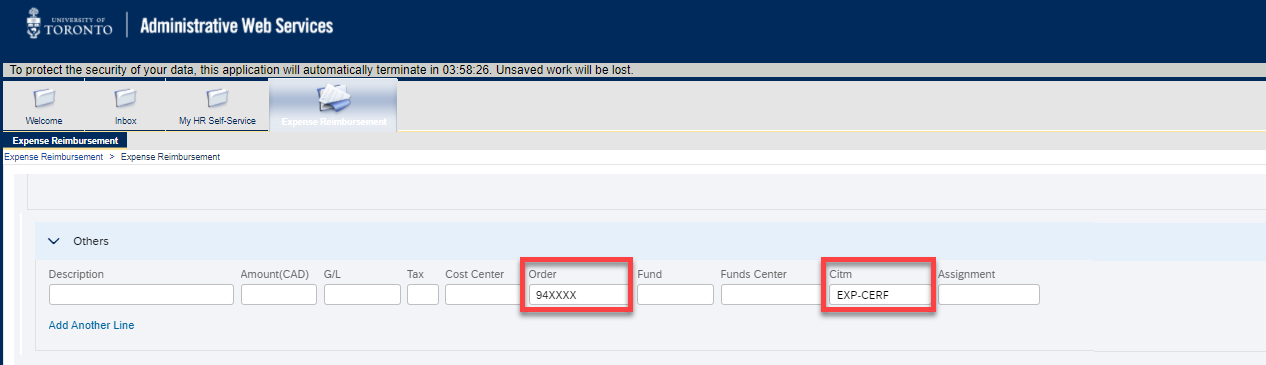

To post against the CERF budget, override the default Commitment Item (e.g. SUPPLIES) and enter the EXP-CERF Commitment Item.

ERDD-web application (Enter ERDD):

Journal Entries

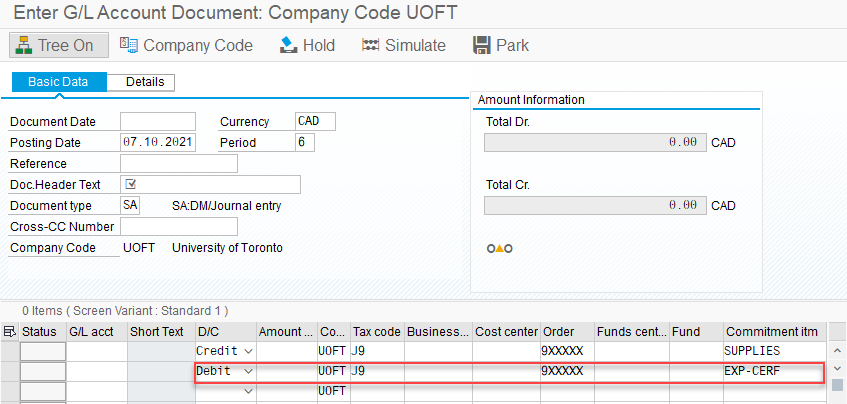

If recovering an eligible expense from a previously claimed reimbursement, process a Journal Entry.

Credit the original funding source accounts (net of tax rebate amount with tax code J9) and debit the CERF budget by overriding the default Commitment Item (e.g. SUPPLIES) and enter the EXP-CERF Commitment Item. (Note: the previously created Faculty COVID Internal Order should be used).

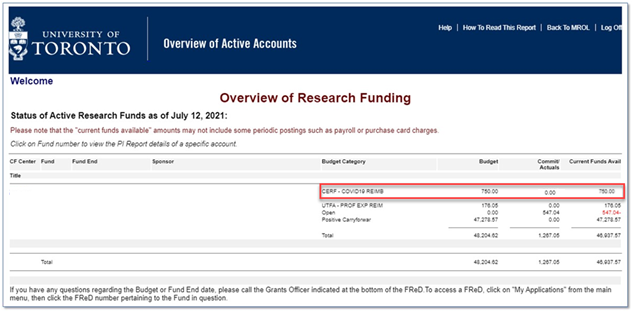

Reporting

Reports to track spending against the EXP-CERF Commitment Item can be run at the individual Funds Center.

FIS Reports

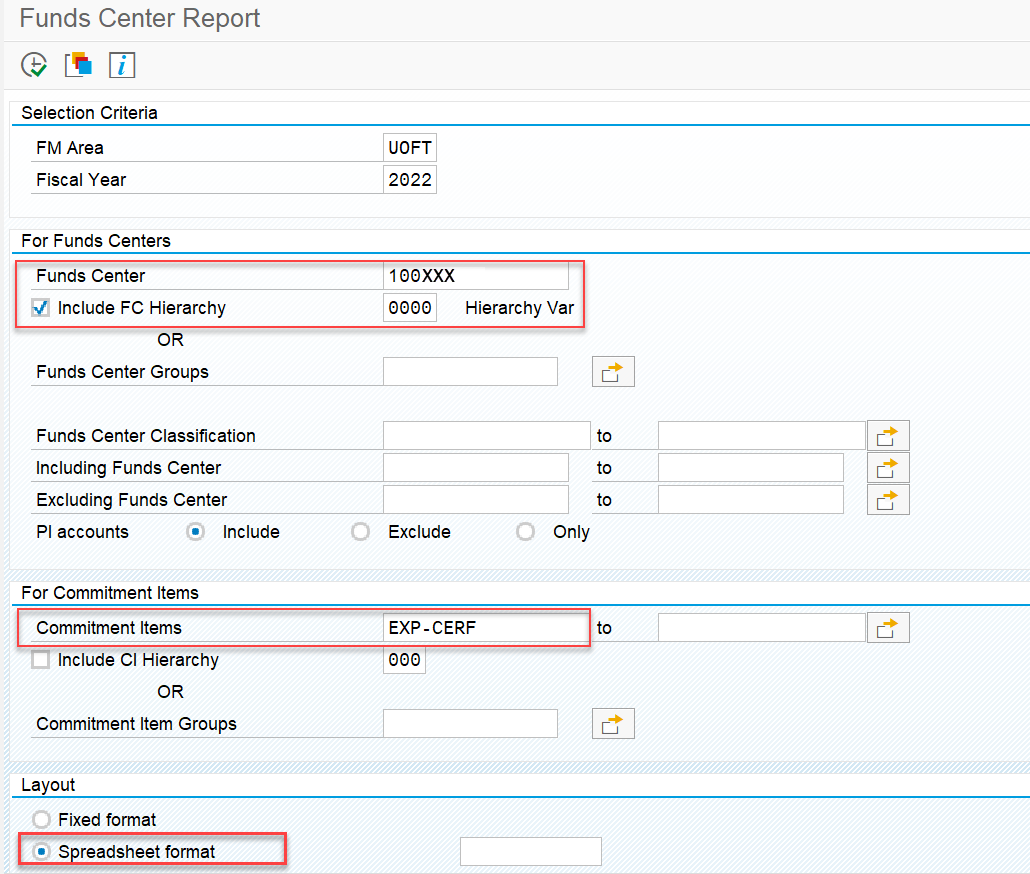

Fund Center Report by Hierarchy – ZFTR111

Recommended Selection Screen Criteria:

Questions

For questions regarding the processing and reporting of CERF funds, please reach out to your FAST Team Faculty Representative.

For more information on reimbursements, please visit the Expense Reimbursement Resource Page.

Last Updated: January 23, 2024