KNOWLEDGE CENTRE

How do I process a Journal Entry/Internal Revenue-Expense Recovery for Airfare expenses after the Air Travel Emissions Mitigation Initiative (ATEMI)?

As a result of the Air Travel Emissions Mitigation Initiative (ATEMI), departments who incur airfare related expenses will be charged an ATEMI fee monthly to operating and PI funds centers based on the Flight Class of service (ECONOMY or ABOVE-ECONOMY) and number of KM flown (i.e., between departure and arrival airports).

ATEMI Fee

| ECONOMY class airfare | $0.0055/km flown |

| ABOVE-ECONOMY class airfare | $0.011/km flown |

If a department needs to reallocate or recover all or part of this ATEMI fee, they do not need to enter/update the number of KM in the Journal Entry or Internal Revenue Expense Recovery.

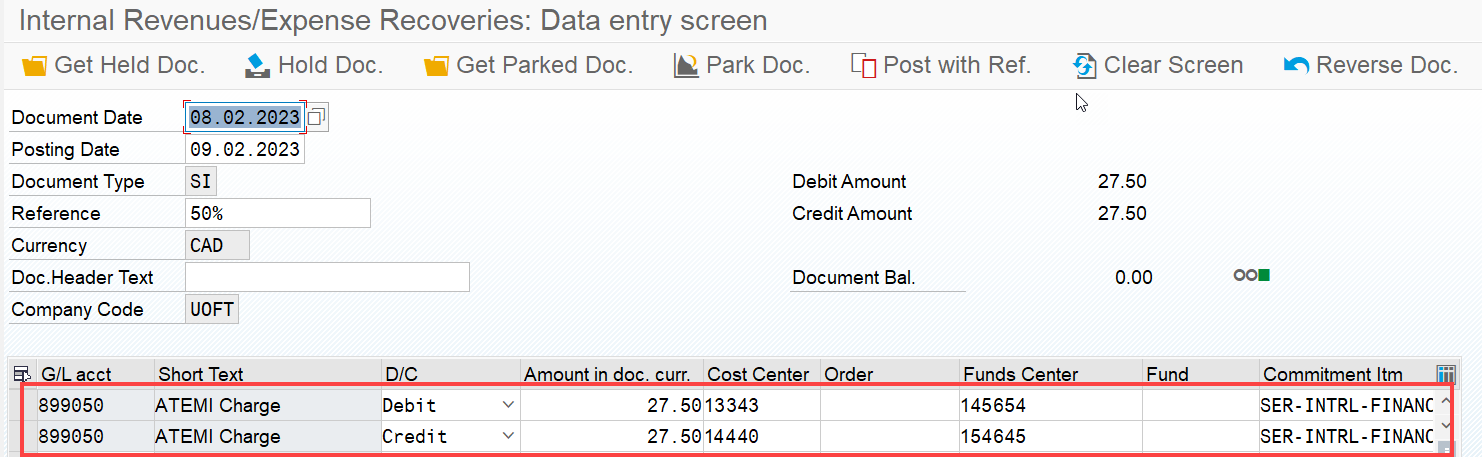

Example:

In a particular month, if a department incurred airfare charges for 10,000 km flown at ECONOMY class (i.e. $55.00 fee), and the department is recovering 50% from another department, they only need to process the internal revenue/recovery transaction for 50% of the fee (i.e. $27.50). They do not enter the km again since it was already input in the original reimbursement and accounted for in the original fee.

If you have any questions, please contact your FAST Team representative.

Learn More:

Last Updated: March 19, 2024