KNOWLEDGE CENTRE

HST Requirements for the University Name on Invoices

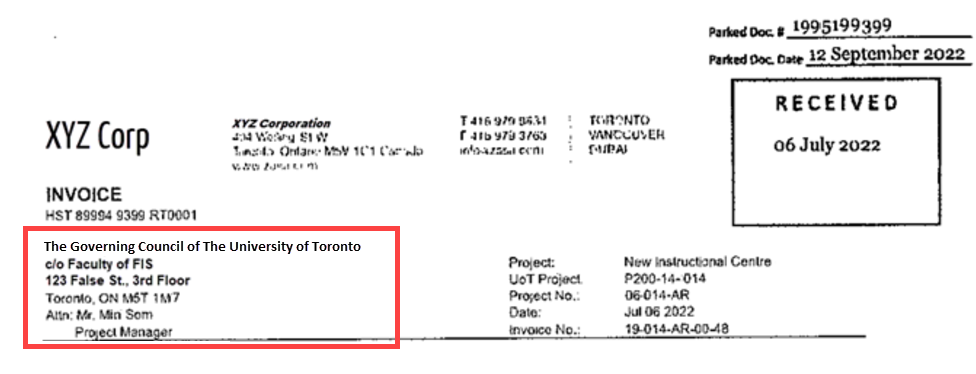

Central Financial Services has observed an increasing number of invoices from commercial vendors where the buyer information (i.e., the University) is incorrectly identified by the vendor. Specifically, the buyer is incorrectly identified as the department and not “The Governing Council of the University of Toronto” or “University of Toronto”.

This may result in the Canada Revenue Agency (CRA) denying the GST/HST rebates that are initially claimed by departments when invoices are processed in AMS.

It is important for departments to carefully review invoices received to ensure that the buyer is identified as the “The Governing Council of the University of Toronto” or “University of Toronto” on the first line, and not the department. The department should be identified on the second line.

For example:

| The Governing Council of the University of Toronto |

| c/o Faculty of FIS |

| 123 False St., |

| 3rd Floor Toronto, ON |

| M5S 1A5 |

Learn More:

Last Updated: July 8, 2025