KNOWLEDGE CENTRE

Issues with ERDD?

Here are a couple of common ERDD issues and how you can resolve them:

1a. The claimant hasn’t received their expense reimbursement.

All ERDDs will automatically be “Parked” if the amount of the claim is:

- Equal to or greater than $10,000 for an appointed staff member or

- Equal to or greater than $5,000 for non-appointed, casual staff member

The reimbursement will NOT be processed until copies of all related documentation are forwarded to Accounts Payable at:

Please send a copy of the entire expense reimbursement report including the supporting documentation to Accounts Payable. Once verified, Accounts payable will post the parked document.

1b. When entering an ERDD payment the message “Vendor Blocked and Marked for Deletion” appears.

Whenever a casual or full-time staff member has a gap in their employment or a change in their employment status (i.e., casual to full-time), the system will automatically block the vendor account (8XXXXX) that is associated with their HRIS record.

To correct this you must first confirm the employee’s status is ‘Active’ and then send an email to requesting that the employee’s ERDD vendor account be manually unblocked.

The issue when processing a reimbursement using ERDD on the web is that the vendor # does not appear on the screen.

Follow the steps below to locate the vendor # for the employee:

STEP 1: Confirm that the employee is active in HRIS.

If yes, then proceed to the next step. If the person is no longer active in HRIS, confirm they should be receiving the reimbursement and then process in FIS as a standard cheque expense reimbursement.

STEP 2: Locate ERDD Vendor #

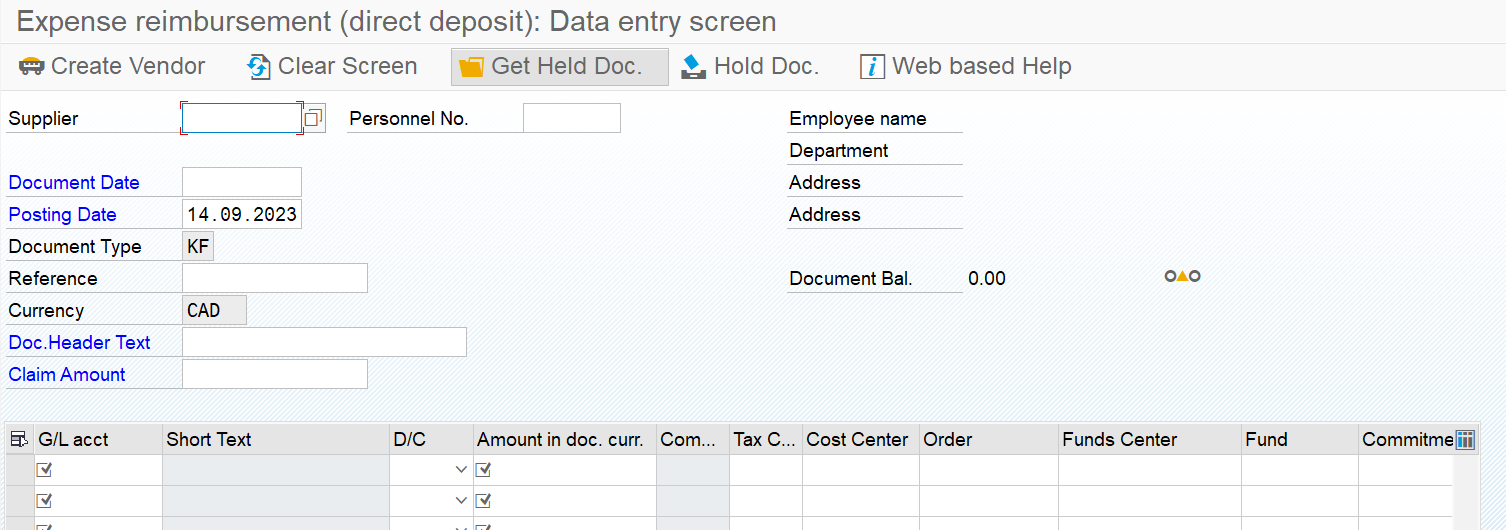

Use the following menu path(s) to go to the ERDD transaction in FIS:

- Accounting >> Financial Accounting >> Accounts Payable >> Document Entry >> Expense Reimbursement Direct Deposit

- Enter the Personnel # of the employee in the Personnel no. field and hit enter

- The Vendor field will be populated with the vendor account #

Learn More:

- Form – Expense Report/Accountable Advance Settlement Form

- Reference Guide – Enter Expense Reimbursement Direct Deposit (FIS) – ZER01

- Simulation – Enter Expense Reimbursement Direct Deposit (FIR) – ZER01

- FAQ Documentation & Support – Expense Reimbursements

- Reference Guide – ERDD on the Web

Last Updated: June 20, 2024