KNOWLEDGE CENTRE

Picking the Correct Tax Code for Expense Reimbursements

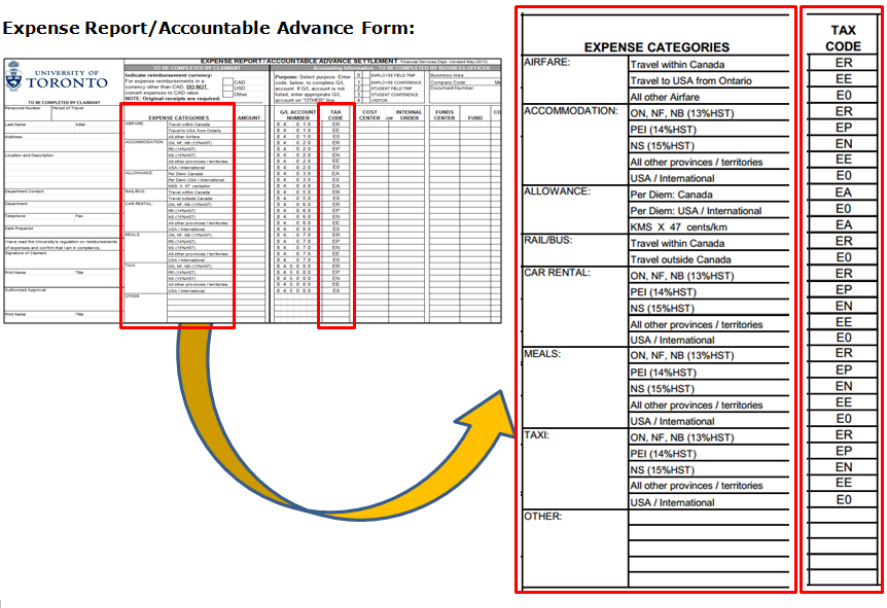

The University of Toronto Expense Report/Accountable Advance Settlement form should be completed and signed for every reimbursement. As illustrated in the form, unless HST exempt (E0), an alpha-alpha (e.g. ER) tax code should be used when reimbursing for expenses that fall into any of the predefined expense categories on the form.

In addition to the predefined expense categories above, use alpha-alpha tax codes whenever taxes should be self-assessed, such as:

- Purchases of computers or conference fees (EC)

- Downloaded software purchased from outside Canada (ES)

Any expenses that do not fall into any of the predefined expense categories above should use the regular alpha-numeric expense tax codes (e.g. E1). These would be indicated in the ‘Other’ section of the Expense Report form.

Learn More:

- GTFM Policy: Travel and Other Reimbursable Expenses

- Resource: Tax Code Summary Table

- FAQ: HST – Expense Reimbursements

- Training Documentation: Managing Travel & Other Reimbursable Expenses

- Reference Guide – Enter Expense Reimbursement Cheque (Single Currency)

- Simulation – Enter Expense Reimbursement Cheque (Single Currency)

- Reference Guide – Enter Expense Reimbursement Direct Deposit

- Simulation – Enter Expense Reimbursement Direct Deposit

Last Updated: June 18, 2020