Harmonized Sales Tax (HST)

The Harmonized Sales Tax (HST) applies to the majority of goods and non-employment services purchased by the University in Ontario.

However, the University is eligible for partial rebates paid on items purchased. For Universities the rebate is 67% of the GST portion of the HST paid and a 78% rebate on the provincial portion (PVAT) of the HST paid.

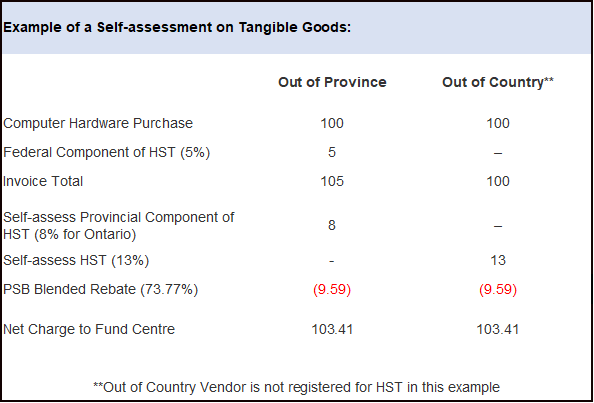

Therefore, the University claims a total rebate of 9.59% of the 13% HST. This rebate is broken into 3.35% (67% of 5% GST portion paid) and 6.24% (78% of the 8% PVAT portion paid); the net HST cost to the University is 3.41% (13% minus 9.59%).

The buying department cost therefore is, the supplier’s invoice amount including (usually) HST at 13% less the HST rebate.

The University’s suppliers (vendors) may handle HST in several ways:

- Assess HST on the invoice and remit to CRA

- HST not assessed or only GST charged requiring the University to self-assess the Ontario portion of the HST.

- HST not applicable (ie. exempt activity or zero-rated for HST)

This section addresses each of these situations and summarizes the buying department’s role with respect to HST.

Other Available References on HST

Each department was provided with the University of Toronto Goods and Services Tax Manual, a comprehensive guide to GST. The sections below are an overview of the areas where questions most often arise. The GST guide for the most part can be used in the same way for HST.

For tax code related questions, please contact your FAST team representative.

In addition, technical expertise on HST issues is available at .

When HST Assessed and Collected by the Supplier

When HST Not Assessed by the Supplier – Do I need to self-assess HST?

When HST Assessed and Collected by the Supplier

When a supplier charges GST/HST on goods or services and the invoice exceeds $499, the invoice must contain the following information.

- The supplier’s business name or trading name or an intermediary’s* name.

- The invoice date, if no invoice issued then the date on which GST/HST is paid or payable.

- The total amount paid or payable.

- An indication of the total amount of GST/HST charged or that the amount paid or payable for each taxable supply (other than zero-rated supplies) includes the GST/HST at the applicable rate.

- An indication of which items are taxed at the GST rate and which are taxed at the HST rate.

- The supplier’s business number (BN) or an intermediary’s BN.

- The buyer’s name or trading name (this should be “The Governing Council of The University of Toronto” or “University of Toronto”) or the name of the buyer’s authorized agent** or representative**.

- A brief description of the property or services.

- The terms of payment.

For the University to be able to claim the rebate and/or input tax credits (ITC), it is imperative that invoices be addressed to “The Governing Council of The University of Toronto” or “University of Toronto” and that either name appear clearly on the invoice as the buyer (recipient) of the goods or service. If you are concerned about invoices not being directed to your department, you may have the vendor insert a second line on the invoice indicating c/o department name. Invoice recipient example:

The Governing Council of the University of Toronto

c/o Financial Services Department

150 College Street, 3rd Floor, Room # 350

Toronto, ON M5S 3E2

If the University’s name is not on the invoice, it must be clear that an agency agreement exists between the University and the authorized agent or representative.

See CRA GST/HST Policy P-182R. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/p-182r/agency.html#P84_9039

Or GST/HST Info Sheet GI-012 https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/gi-012/agents.html

Below is an example where the University would not be eligible to claim the rebate and/or ITC.

Example

Company ABC engaged exclusively in exempt activities, places an order for equipment with a supplier and is liable to pay the consideration for the equipment under the agreement for the supply. UofT actually takes delivery of the goods and uses the equipment exclusively in its exempt activities. The invoice issued by the supplier identifies Company ABC as the customer and lists the shipping address of UofT for delivery purposes. When UofT receives the goods, it pays the supplier and subsequently claims the rebate. As supporting documentation, it uses the invoice made out in the name of Company ABC. However, UofT cannot claim a rebate since it is not the person liable to pay the consideration for the equipment, and therefore is not liable to pay the tax (i.e., it is not the recipient of the supply). The recipient of the initial supply is Company ABC, and as such, it may claim the rebate if it acquires the equipment for consumption, use or supply in the course of its exempt activities and all the other rebate criteria are satisfied. Only if Company ABC in turn re-supplies the equipment to UofT, could UofT claim a rebate for the GST/HST paid or payable on the subsequent supply provided all the other rebate criteria are satisfied.

* An intermediary is a registrant who, under an agreement with you, makes a supply on your behalf, or causes or facilitates the making of the supply by you.

** Agents or representatives

In the Example above, if Company ABC were the agent of UofT, (UofT is the “principal”), and Company ABC acquired the equipment on behalf of UofT in an agent-principal relationship and was acting solely in its capacity as agent when it agreed to pay for the supply, UofT would be eligible to claim the rebate/ITC on the acquisition provided all the other rebate/ITC criteria are satisfied.

Even though the agent may appear to be the recipient of the supply as the agent is identified on the invoice as the customer, it is the principal who is ultimately liable to pay the consideration thereby making the principal the recipient of the supply.

To facilitate the claiming of the rebate/ITCs, the documentary requirements provide for the identification of either the recipient or the recipient’s duly authorized agent or representative. More information on the documentary requirements for claiming rebate and or ITCs will be available in CRA’s Memorandum 8.4, Documentary Requirements for Claiming Input Tax Credits.

When HST Not Assessed by the Supplier – Do I need to self-assess HST?

Taxable goods and services delivered and/or performed in Ontario should be charged HST unless the goods and services qualify for exemption, point-of-sale rebates, or are zero-rated supplies.

It is the responsibility of the individual/department initiating the purchase to determine if goods or service needs to be self-assessed for HST.

The self-assessment rules apply to all purchases by the University. Despite the general rules discussed below, self-assessment on purchases made within Canada will almost never be required by the University. The exception is where a foreign organization, who is not registered for HST, performs a service within Canada. Self-assessment will most often be required on foreign purchases (goods and services delivered from outside of Canada).

To self-assess means to calculate how much HST should be paid on the purchase of a good or service when no HST has been billed on an invoice by the supplier. The HST is then remitted by the University to the CRA. A portion of the self-assessed HST (the amount not eligible for a PSB rebate or other credit) will be charged to the same expense account where the cost of the goods or services are being charged.

a) General Rules

Under the current place of supply rules, the University is required to self-assess tax on any supply of property or service made outside a participating province for use in a participating province. The University may then claim rebates on tax paid according to the rebate rules for Public Service Bodies (PSBs): 67% of the federal HST, 78% of the provincial HST, federal book rebate or 100% of the federal HST on printed books and/or input tax credits (ITC’s). A participating province is a province that charges HST.

Suppliers in non-participating provinces are required to charge HST if the place of supply is in a participating province. If a supplier instead charges GST only or GST and another province’s tax, the supplier should be notified so that the invoice can be changed. Ultimately, the responsibility falls on the domestic supplier to charge the taxes correctly. In some cases, the place of supply may actually be in another province (many travel expenses for example), in which case the supplier will correctly charge a different type of tax since the supply was consumed in that province. The University cannot claim a Public Service Body (PSB) rebate on taxes that are not GST or HST. For example, the University cannot claim a PSB rebate on the PST (5%) from Saskatchewan because Saskatchewan PST is not provincial HST nor is it federal HST.

In practice, self-assessment on supplies purchased within Canada will be extremely rare. The University only has locations (in Ontario), so domestic suppliers should charge the University 13% HST in nearly all situations. Self-assessment will most often be required on purchases from unregistered international suppliers – such as those from the USA. GST/HST registered international suppliers are treated in the same way as domestic suppliers for GST/HST purposes. Some larger corporations in the USA are registered, so this is something to keep in mind. If you do not know if a supplier is registered to collect GST/HST, it is prudent to ask them.

The University can claim rebates on self-assessed tax, and HST charged by registered foreign suppliers in the same way that it would claim rebates on HST charged by domestic suppliers.

For further information on self-assessment, please refer to the CRA’s technical bulletin.

b) Exceptions

The University is not required to self-assess HST on:

- Goods and services purchased in Ontario from a domestic vendor/supplier, where the vendor/supplier does not charge HST. (The responsibility lies with the domestic vendor to charge HST. The department should question the vendor why HST is not being charged.)

- Goods or services that are normally tax-exempt or zero-rated. Keep in mind that, although some services are exempt, it is rare for goods to be exempt. The most common reason for an exemption is the small trader status of the supplier. A supplier has that status if its sales of taxable supply do not exceed $30,000 annually. Goods are more likely to instead be zero-rated or eligible for a point-of-sale rebate.

- Goods or services that are consumed in another province (reimbursement of some travel expenses like meal or accommodation expenses).

- Goods that are for commercial resale (a full input tax credit is available). This is rare for the University.

- Printed books (printed books are exempt from the provincial HST and a 100% rebate on the federal HST is also available). Additionally, there is no requirement to self-assess the provincial portion of the HST on other goods that are eligible for the point-of-sale rebate.

c) If you purchase Tangible Property

Most common case: Self-assess the provincial portion of HST at 8%, and the University receives a 78% rebate on the 8%.

What is Tangible Personal Property?

Tangible personal property in this case refers to items that are physically shipped across the border.

Common examples include:

1) Lab Equipment

2) Computers

How to Self-Assess the HST on a Tangible Property

Typically, such items are assessed 5% GST by the customs broker. If HST is not charged by the vendor (the most common case for foreign suppliers), the University is required to self-assess the HST at the same rate an Ontario vendor would have charged it. If the customs broker has already assessed 5% federal component of HST (ie. GST), the University must self-assess the 8% provincial component of the HST. If you use the University’s custom broker, Thompson Ahern and Company (TACO), our automated billing process with TACO will self-assess the 8% provincial component of the HST.

Example 1: UofT department purchases a piece of lab equipment from a supplier in the United States for $1,000.00. The supplier does not charge HST. The item is shipped across the border and our customs broker (TACO) charges UofT the 5% federal component of the HST at $50.00. The University’s automated billing process with TACO will self-assess the other 8% at $80.00. The UofT department should process the foreign vendor invoice using the E0 tax code.

Example 2: UofT department purchases furniture from a supplier in the United States for $1,000.00 and $130.00 HST. Since the supplier charged the full HST, there is no requirement for self-assessment. The UofT department will process invoice using the regular E1 Tax code.

Example 3: UofT department purchases software from a supplier in the United States for $100.00 and the software is shipped to UofT in the form of a USB. The supplier does not charge HST. The item is shipped across the border and our customs broker (TACO) charges UofT the 5% federal component of the HST at $5.00. The University’s automated billing process with TACO will self-assess the other 8% at $8.00. The UofT department should process the foreign vendor invoice using the E0 tax code.

Example 4: UofT department purchases a book (assume it is a qualifying book) from a supplier in France for use in the library. The foreign supplier charges 5% federal HST. In this case the University would not have to self-assess the 8% provincial HST since qualifying printed books are eligible for a point-of-sale rebate on the provincial component of the HST. UofT is also eligible for a 100% book rebate on the federal component of the HST instead of the usual 67% PSB rebate on the federal portion of the HST (provided that the books are not for resale). The UofT department will process the supplier invoice using the E5 tax code.

d) If you purchase Intangible Property

Most Common Case: Self-assess HST at 13%, UofT department claims a combined PSB rebate of 73.77%

What is Intangible Property?

Intangible personal property typically refers to the supply of electronic goods or rights to access content. If the intangible property can be used in a participating province, self-assessment is required.

Common examples include:

1) Electronic subscriptions (library databases, site access)

2) License agreements (software, intellectual property)

How to Self-assess the HST on Intangible Property

Intangible supplies do not go through customs. Unless the foreign vendor charges the HST, no tax will be charged. The University is required to self-assess the full HST on any taxable intangible supplies that are consumed in a participating province.

Example: UofT department purchases the right to access an electronic database of research journals from a supplier in the United States for $10,000.00. The supplier does not charge tax and the item is not shipped so our broker does not assess any tax. The database is for use primarily (>50%) in Ontario so the UofT department must self-assess the full 13% HST when processing the foreign invoice by using the ES tax code.

e) If you purchase a Service

Most Common Case: Self-assess HST at 13%, UofT department claims a combined PSB rebate of 73.77%.

For services that relate to a location specific event or tangible goods:

The UofT department is required to self-assess the HST if the service is performed in relation to tangible property that is located in a participating province or a location specific event that takes place in a participating province.

For services that are not in relation to tangible personal property or a location specific event:

The UofT department is required to self-assess the HST if the service takes place in a participating province or the service provider obtains a billing address in a participating province.

Example 1: A contractor from the UK is hired to inspect a piece of equipment that is located in the UK. The service takes place entirely in the UK so no HST is due. The UofT department should process the foreign vendor invoice using the E0 tax code.

Example 2: A consultant from the United States is hired to assist in the completion of a report that is to be used in Ontario. He does not charge HST. Since the supply is to be used in Ontario, the UofT department must self-assess the HST at 13%. The UofT department should process the foreign vendor invoice using the ES tax code.

Example 3: A consultant bills UofT for advice he gave over the phone while he was in the United States. He does not charge any HST. Since the consultant billed the UofT department at its address in Ontario, the place of supply is Ontario and the UofT department must self-assess HST at 13%. The UofT department should process the foreign vendor invoice using the ES tax code.

When HST Not Applicable

The following are examples of purchases taxed at the rate of zero. Therefore, the seller (the supplier / vendor to the University) is not required to collect HST on these sales.

- prescription drugs

- medical devices

- basic groceries other than alcohol, snack foods, sweetened baked goods, restaurant meals and take-out foods

- agricultural and fishing supplies including:

- fresh fish and other marine animals for human consumption

- livestock, poultry, raw wool and certain agricultural produce

- certain machinery and equipment designed for farmers or fishermen

- exports of goods and services

- international passenger travel services

- international freight transportation services

- supplies made to international organizations and officials including diplomats and member of visiting armed forces

- certain financial services

- initial sales or importations of precious metals

- feminine hygiene products

The following are examples of purchases exempt from HST:

- goods and services provided by small suppliers

- health care, childcare and legal aid services

- educational services provided by elementary and secondary schools, publicly funded colleges and universities, and private secretarial schools and business colleges

- a broad range of supplies of a non-commercial nature by charities, non-profit organizations, municipalities, and federal and provincial governments

- sales of used residential housing and rentals of residential premises

- most domestic financial services

- certain intra-group financial services

- ferry, road and bridge tolls

Last revision: October 18, 2022